ct sales tax exemptions

Several exemptions are certain types of safety gear some types of groceries certain types of clothing childrens car seats childrens bicycle helmets college textbooks compact fluorescent light bulbs most types of medical. You do not have to pay state sales tax if the vehicle is registered in the same name - in another state - at least 30 days before establishing Connecticut residency.

Sales Tax Exemptions Finance And Treasury

CT Use Tax for Individuals.

. The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST. Amending a Sales and Use Tax Return. Sales And Use Tax Exemption.

The issuing buyer and the. Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. The connecticut sales tax rate is 635 as of 2021 and no local sales tax is collected in addition to the ct state tax.

Services of self-employed welder exempt from sales tax. In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. For a complete list of exemptions from connecticut sales taxes refer to conn.

The state imposes sales and use taxes on retail sales of tangible personal property and services. Counties and cities are not allowed to collect. In limited circumstances the university may purchase items for resale.

Click here for more information. The HST was adopted in Ontario on July 1st 2010. In addition to the state sales tax there is a 45 transfer tax that applies to the sale of motor vehicles and a 1 tax that applies to certain computer services.

With the support of state government organizations and private. Exact tax amount may vary for different items. If the buyer is entitled to a sales tax exemption the buyer should complete the certificate and send it to the seller at its earliest convenience.

Groceries prescription drugs and non-prescription drugs are exempt from the Connecticut sales tax. Tax exemptions for blind persons state law provides a 3000 property tax assessment exemption for property owners who are blind. Connecticut sales and use taxes are imposed on the sale of all tangible personal property and certain enumerated services unless specifi cally exempt from this tax by statute.

Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13. Workforce Programs in Connecticut. 2021 Connecticut Sales Tax Free Week.

Farm vehicles ambulances training vehicles and commercial vehicles are exempt from the state. Connecticut is a member of the Streamlined Sales and Use Tax Agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states. Sales Tax Exemptions in Connecticut.

Ad Access Tax Forms. Download Or Email OS-114 More Fillable Forms Register and Subscribe Now. An 8 provincial sales tax and a 5 federal.

The HST is made up of two components. Complete Edit or Print Tax Forms Instantly. This is not a complete list of exemptions but it does include purchases commonly made by individual consumers.

Also there is no sales tax levied on cars that are received as gifts. For a complete list of exemptions from Connecticut sales taxes refer to Conn. Vendors at Flea Markets.

Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635. Exemptions from sales tax scroll to instructions 10112.

The state imposes sales and use taxes on retail sales of tangible personal property and services. 44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut. Exemptions from Sales and Use Taxes.

It imposes a 635 tax with some exceptions on the retail sales of tangible personal property purchased 1 in Connecticut ie sales tax or 2 outside Connecticut for use here ie use tax. The following is a list of items that are exempt from Connecticut sales and use taxes. Because Connecticut is a member of this agreement buyers can use the Multistate Tax Commission MTC Uniform Sales Tax Certificate when making qualifying sales-tax-exempt.

An organization that was issued a federal Determination Letter of exemption under Section 50lc3 or 13 of the Internal Revenue Code is a qualifying organization for the purposes of the exemption from sales and use taxes. Connecticut utility sales tax exemption. Ad Download Or Email CERT-141 More Fillable Forms Register and Subscribe Now.

Obtaining a Duplicate Sales Tax Permit. Sales tax to be collected if at all at time of original transfer. These taxes apply to any item of tangible personal property unless the law.

Business Taxes Capital Base Tax Phase Out This session the legislature delayed the start date of the capital base tax phase out by three years and extended the phase out period. Manufacturing Machinery and Equipment Tax Exemption Learn about a five-year 100 property tax exemption for. It imposes a 635 tax with some exceptions on the retail sales of tangible personal property purchased 1 in Connecticut ie sales tax or 2 outside Connecticut for use here ie use tax.

The state of Connecticut has relatively simple sales tax rate and is one of the few states which does not have a local or county tax in addition to the state sales tax. The 2021 CT Tax Amnesty Program offers a limited opportunity to make it right. Connecticut State Department of Revenue Services.

Manufacturing and Biotech Sales and Use Tax Exemption See if your manufacturing or biotech company is eligible for a 100 or 50 tax exemption. 2022 Connecticut state sales tax. Connecticuts Workforce Development Program is led by the Governors Workforce Council in partnership with the Department of Economic and Community Development AdvanceCT and a number of other partners around the state.

Connecticut for employers in other states must be allowed a Connecticut income tax credit for taxes paid to the other state for the 2020 tax year PA 21-3 1 effective upon passage. Ad CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now. - If you filed 2020 Schedule CT-EITC Connecticut Earned Income Tax Credit along with your 2020 Form CT-1040 Connecticut Income Tax.

When Sales Tax Is Exempt in Connecticut. Examples of Clothing or Footwear That Are Exempt When Sold for Less Than 100. Applying for a Sales Tax Permit Resale Number Retailers Advertisements.

Full and partial exemptions from sales and use taxes are available to quali fi ed manufacturers fabricators and processors. Sales Taxes in Ontario. - Do you owe back taxes.

This Informational Publication is a reference of available benefits. These taxes apply to any item of tangible personal property unless the law expressly exempts.

Sales Tax Exemption For Building Materials Used In State Construction Projects

Form Rev36 0001e Download Fillable Pdf Or Fill Online Tax Exemption For Sales To Tribes Washington Templateroller

Exemptions From The Connecticut Sales Tax

Tax Exemptions And Resale Certificates

.png)

States Sales Taxes On Software Tax Foundation

Download Business Forms Premier1supplies

Sales And Use Tax Exemption Certificate Form 149 Tax Exemption Filing Taxes Tax

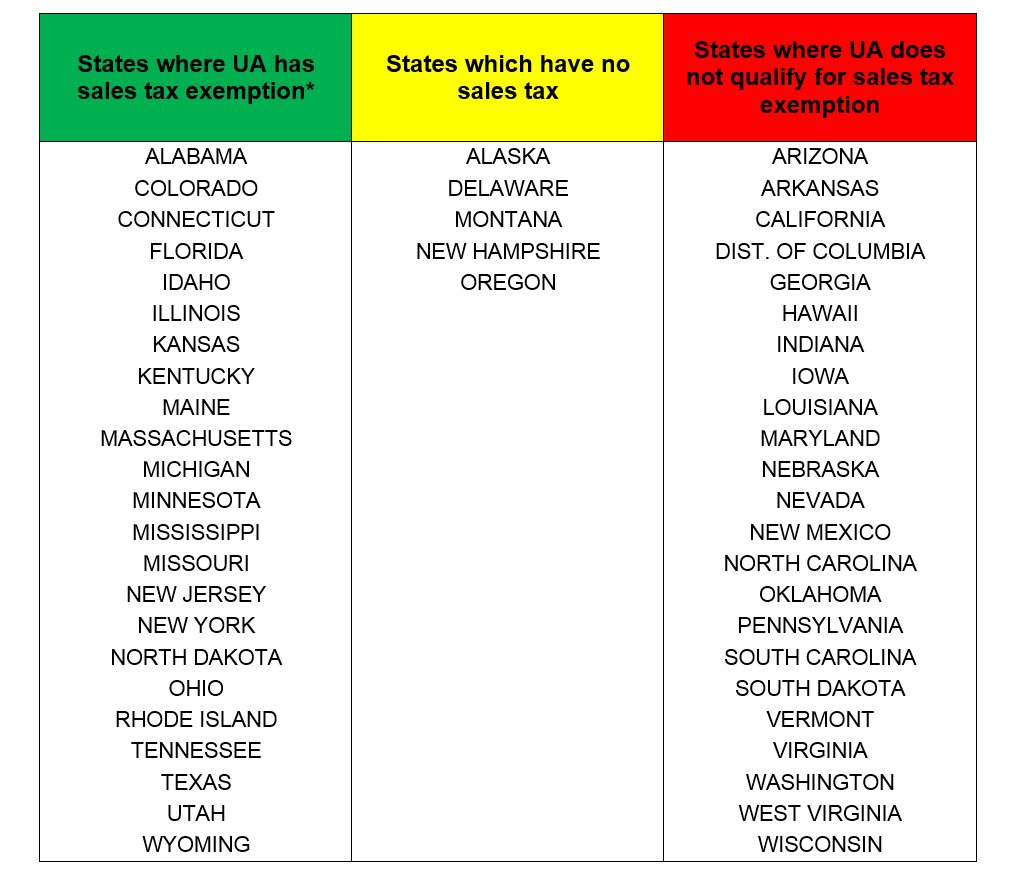

Other States Tax Exemption Tax Office The University Of Alabama